Pay Yourself First: The Solution to Saving for Your Future

How often do you set financial goals for yourself? Do you have a financial plan in place to start saving for retirement, or are you waiting until the end of the month to see how much money is left over before deciding what to do with it? If this sounds like you, then your future […]

Why You Should Take the Media With a Grain of Salt

The media can be a powerful tool in shaping our opinions and beliefs. Financial planning and investing are important topics, but the information out there is often contradictory and confusing. It is hard to know what you should believe when it seems like everything has been said about the subject already. Luckily, we are here […]

Willing Wisdom – Estate Planning With Tom Deans

Over 50% of Canadians either do not have a will, or it is outdated. Most of us don’t like to talk about death, but failing to plan for it can lead to a lot of chaos and anger for the loved ones we leave behind. In this episode, Richard and Matt are joined by Tom […]

How to Achieve Your Financial Dreams

Most people work for goals that don’t matter to them. Financial planning is critical to a successful life, yet many people never do it. Financial planning can be confusing and overwhelming at first, but it’s not as difficult as you might think once you follow a process. This post will discuss how to achieve financial […]

Stay in Your Seat

Whether at a sports game or investing, many people get distracted, zone out, or sometimes actually fall asleep, often missing a crucial game-changing event. As a result, we end up disappointed in our experience. In this episode, Richard and Matt discuss how a successful investment experience requires that we stay disciplined through the ups and […]

Do You Know How All the Pieces of Your Retirement Fit Together?

Growing up, I have fond memories of time spent with my father Richard making trips to Ikea for furniture. Imagine a young, curious boy who was amazed by the shelves in the warehouse full of neatly packaged furniture. That was never where the fun ended. Once we brought our boxes home, there was the joyous […]

The Big Obstacles to Investing in an RRSP

Do You Hate RRSPs? You’re Not Alone. The RRSP is one of the most important tools in your financial plan. However, there are a number of obstacles that prevent many Canadians from using this powerful tool to their advantage. If you have any of these objections, you’re not alone! In this post we break down […]

Avoid Unnecessary Investment Risks

“There’s no such thing as a free lunch.” Economist Milton Friedman may have said this, but the phrase’s originally dates back to a 19th century practice in American bars of offering a free lunch to entice the more lucrative drinking customers. The same goes with our investments! In this episode, Richard and Matt talk about […]

Protect Your Legacy: Get a Plan

You have worked too hard to have your entire legacy destroyed due to lack of a plan. Without a proper estate plan, your family could end up paying a lot of taxes and fighting over your assets. Estate planning can be overwhelming, but it is an essential step in preserving your financial future and the […]

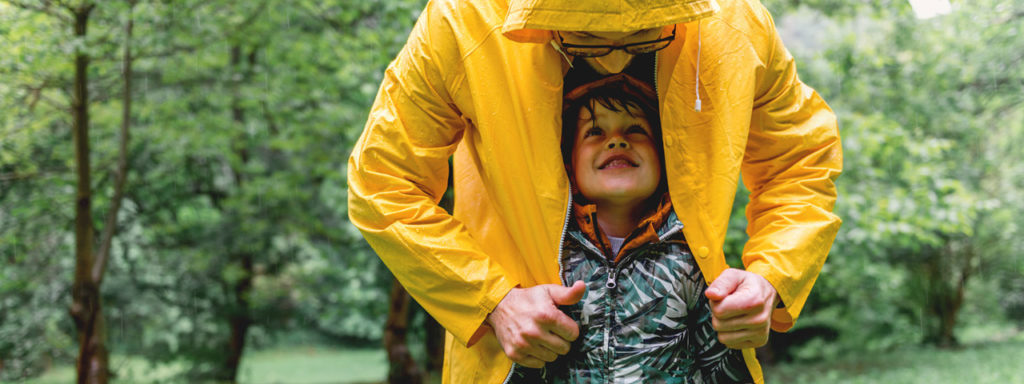

Insurance to Protect Your Family and Goals if the Worst Happens.

It can be hard to think about the future when so much is happening in the present. But what will happen if life throws a curve ball your way? Personal insurance can help protect yourself and those around you from financial catastrophe. Life insurance ensures that there’s a plan for income replacement, mortgage or rent […]

Canadians are Worrying About Retirement. Here’s What to Do

Retirement is a time when people can finally relax and enjoy their lives. Unfortunately, many Canadians are running out of money in retirement and are worried about the future. It is important that Canadians take steps now to ensure they have the proper retirement plan in place. Planning for your financial future does not need […]

Diversify Properly

Diversification is critical to any wealth-building strategy. In this episode, Richard and Matt discuss why diversification is important, how we should think about it, and the risks of under diversification.

A Comprehensive Financial Plan: You Need One to be On Track

Financial plans are important to reach your goals. The problem is that many Canadians do not have one, or they don’t know if their plan is working for them. A comprehensive financial plan will help you set clear financial goals and develop strategies to achieve these goals. A comprehensive financial plan can be the difference […]

Protect Your Most Valuable Assets First

We insure everything around us, our cars, our televisions, our phones, etc. Rarely do we insure our most valuable asset – ourselves and our human capital. In this episode, Richard and Matt discuss what human capital is and how we can protect it. https://www.insuresmart.ca/

Personal Pension Plans w/JP Laporte

Incorporated business owners are often not aware that they can access higher tax deductions than are available through traditional RRSPs. They can also gain greater security and flexibility. In this episode, we interview Jean-Pierre (JP) LaPorte, a pension lawyer and one of Canada’s foremost experts on the subject of Personal Pension Plans.

Pay Yourself First

Often people save for their future based on what’s left at the end of the month. This amount usually ends up being an afterthought compared to a priority. In this episode, Richard and Matt discuss one important strategy to prioritize and progress in your financial goals.

Start Now With What You Have

Many people are stuck with the following questions when it comes to their finance, “Am I too old or young to start? Is it too early or late for me to start? When do I start?” In this episode, Richard and Matt go through a structure that guides you how to start now with what […]

Start A Financial Plan

Many Canadians do not achieve the financial goals that matter to them. Worse than that, they never know if they are on track. In this episode, Richard and Matt discuss the benefits of a financial plan to your future. https://wealthsmart.ca/myplan/

After the Storm

With everything beginning to open up, it is important to reflect and learn as much as we can from this difficult time. In this episode, Richard and Matt walk through some of their insights over the past year and how it relates to our lives going forward. Here is a link to the “Scary Times […]

Building Financial Confidence

Financial confidence is the key to achieving the goals that matter to us. There is a process to developing financial confidence. In this episode, Richard and Matt discuss the process for building financial confidence. Get 10 Ways To 10X Your Wealth 10X