10 Steps to 10X Your Financial Freedom

Introduction

We all want Financial Freedom.

Wouldn’t it be so much easier if you could 10X your Financial Freedom? It sounds difficult, but if you do it the right way, it can actually be easier to 10X your Financial Freedom than to double it! Doubling your Financial Freedom can be done through brutal hard work using our existing knowledge, attitudes, skills and habits. If we simply apply steady improvement in 10 different areas of our finances though, a 10X result is entirely possible!

What gets in the way is not knowing when or how to start. There is so much information on the internet that we may feel overwhelmed. We often will procrastinate or not get started at all.

I love the following introduction to comedian, Steve Martin’s famous skit:

“You can be a millionaire, and never pay taxes! You say ‘Steve, how can I be a millionaire and never pay taxes?’ First, get a million dollars. Now you say, ‘Steve, what do I say to the tax man when he comes to my door and says, ‘You have never paid taxes?’ Two simple words. Two simple words in the English language: ‘I forgot!’”

Steve Martin probably made millions of dollars over the years just from that skit!

But we usually must start with a lot less than a million dollars and tax avoidance is a crime!

If you have a dollar, it should not take more than a day to 10X your wealth! Same thing with ten dollars or a hundred dollars. Simple arithmetic tells us that even a thousand dollars can be multiplied tenfold by simply spending less than you earn.

The best time to plant a tree was 20 years ago. The second-best time is now.”

Chinese Proverb Tweet

This is where it gets more difficult. If you are beginning with $10,000 or $100,000, your financial plan needs to start firing on all cylinders to begin the wealth building process with a vision of multiplying your wealth ten-fold.

These “10 Steps to 10X Your Wealth” are designed to help you act on your goals, while building the knowledge to understand why each is important.

It is impossible to summarize financial wisdom, and many of the concepts we dive into can be confusing. This eBook is simply an introduction to the strategies and mindsets that will help you establish an exponential approach to building wealth. This can be rocket fuel for your dreams.

Can we help you 10X Your Wealth in 10 Steps? Read on to find out!

Table of Contents

1. Start a Real Financial Plan

Do you ever worry about the following:

- “Will I be okay financially?”

- “Will my family be okay?”

It’s difficult when you don’t know for sure.

A great financial plan is the answer, but it can be overwhelming. Most of us never learned this in school. We are left to dig around on the internet finding information that doesn’t really answer our questions.

If we don’t get clarity about our financial future, we will continue to stay stuck.

In the 2019 Canadian Financial Capabilities Survey, only 40% of Canadians said they found ways to increase their financial knowledge, skills and confidence in the past 5 years. This comes despite an abundance of resources available through online sources and through qualified financial professionals, such as Certified Financial Planners.

There’s good news on the horizon though!

In 2013, FP Canada conducted a three-year study of almost 15,000 people. Without fail, those who had a financial plan had a far better success rate than those without one.

The study found that these “Planners” experience the following:

- On track with financial affairs. Planners are more likely to feel on track with their financial affairs compared with those who do no planning or only limited planning.

- On track to retire. Those who see retirement as an important goal feel more confident in their plans to retire.

- On track to save. Planners are more likely to have improved their ability to save over the last five years.

- Could deal with bumps in life. Planners are more confident in dealing with unexpected financial emergencies and tough economic times. Planner are also more confident that loved ones will be okay financially in event of death.

- Can live life abundantly today. While saving for the future is crucial, we must live today! Planners are more confident in reaching the “today” goals they identified as important.

- A stronger sense of well-being. Those with comprehensive plans have higher emotional, financial & overall contentment.

Those who work with financial planning professionals in crafting a comprehensive financial plan will have far better outcomes than those who don’t.

The biggest barriers in establishing a financial plan are fear and overwhelm. The best approach is to just start, even if it is with simple tools. We have a free financial planning tool on our website and you are very welcome to use it. You can start right now by scheduling a quick chat with us.

Your first step in starting a financial plan will not be perfect, but remember – progress comes before perfection.

2. Start Now With What You Have

We all want to grow.

It is easy to compare the goals we set for ourselves against the progress we’ve made. If we’re honest, there will always be a gap! There is nothing wrong with that. Goals should motivate us, not discourage us when we don’t achieve them.

It is more useful to look backwards and be grateful for and celebrate the progress we have actually made. We learn more from failures than we do from our successes!

No matter where you are in your financial journey, it is important to understand where you are right now without any judgement over where you feel you should be. Right now is the only thing you have control over.

Before you begin, your journey is doomed if you are consistently spending more than you earn. Twentieth century philosopher Bill Earle said “if your outgo exceeds your income, then your upkeep will be your downfall.” Everything you build begins with cash flow. Simply put – spend less than you earn!

All progress begins with the truth. It is important to look for truth-tellers in your life. Look for a good financial advisor who is not afraid to tell the truth about your situation.

Just like any serious business owner, you must understand your cash flow and net worth. You can take a huge step forward by using our financial calculators resource at www.wealthsmart.ca/calculators and creating your own Net Worth and Cash Flow statements.

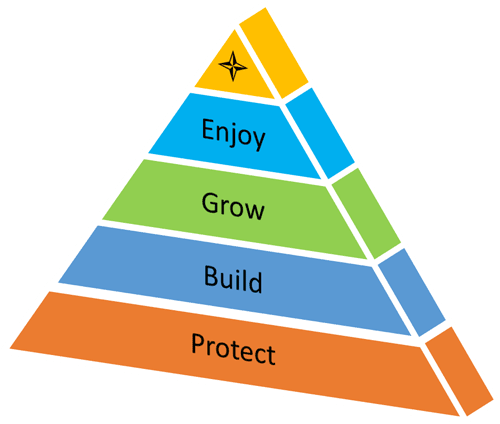

The Wealth Triangle

The words “pyramid” and “wealth,” when mixed together, have us thinking of “pyramid schemes” and that is a dark road we all want to avoid! Let’s reframe those words by going back a few thousand years.

The ancient Egyptians eventually got it right. They learned that the steeper the slope of the pyramid, the more likely it was to collapse. The broader pyramids had much larger, wider and stronger bases than other designs. This is how we have to think about our personal finances. We call it the Wealth Triangle.

There are five stages that must be built in the following order. Trying to build them from the top down brings to mind another triangle –

Level 1: Protect Your Wealth

- Insurance to protect your financial future. Remember – cash flow is key. If you can’t work because of a critical illness, disability, or death, your wealth and your family’s wealth will be impacted.

- Reducing/eliminating consumer debt. Debt is a liability and reduces your net worth by the amount outstanding. You need to differentiate between debt that works against your better interests and debt that works for you in the long run.

- Consumer debt (e.g. credit cards) charges high interest rates and helps you to buy things that depreciate or have no real value. The high interest paid erodes your wealth.

- Secured debt charges lower interest rates because it is secured by property (for example, a mortgage is secured by your home). Secured debt can help you to build wealth when used to buy an asset that gives you long-term value and appreciates over time.

- Emergency fund or secured line of credit. Emergencies and unexpected expenses happen. Relying on expensive credit card debt is a bad idea. We need a buffer between our financial futures and reality. You should have enough to cover at least 3 – 6 months of expenses.

Level 2: Build Your Wealth

- Retirement Planning – for long-term retirement income, you will probably need to set up a Registered Retirement Savings Plan (RRSP) which will allow you to deduct the amounts you set aside from your taxable income and defer that income tax into the retirement years when your income will probably be lower. If you are transitioning from one employer to another, you may need to move your pension entitlement into a Locked In Retirement Account (LIRA)

- Tax-free long-term accumulation – if you are saving for mid to long-term goals, including retirement or saving for a large investment like another property, a Tax-Free Savings Account (TFSA) could be the right structure. You can withdraw your money any time and the tax-free compounded growth can be incredibly powerful over time!

- Home Ownership – Depending on your economic circumstances and where you want to live, home ownership may or may not be on your radar. Home ownership is a serious long-term decision and needs to be planned for without compromising your long-term wealth.

- Post-Secondary Education – Saving for post-secondary educations can seem like a challenge. The Registered Education Savings Plan (RESP) together with the Canada Education Savings Grant (CESG) can help you save for these expenses.

- Short-term Savings Goals – Are you saving for a car, home renovation or a big vacation? For short-term goals, set up a separate account that is not so easy to spend. Stick to guaranteed vehicles such High Interest Savings Accounts or GICs.

When answering the question; “what job do you want your money to do for you,” you must understand wealth building structures. The next challenge lies in properly growing and optimizing the wealth within.

Level 3: Grow Your Wealth

Warren Buffet said: “To invest successfully over a lifetime does not require a stratospheric IQ, unusual business insight, or inside information. What’s needed is a sound intellectual framework for making decisions and the ability to keep emotions from corroding that framework.”

Investing requires purposeful thought in building a portfolio that follows science rather than speculation.

Think carefully about “human capital diversification” as well.

What is human capital diversification?

When our occupations or businesses are focused in one sector, so is our job risk. For instance, realtors should probably focus less of their wealth in real estate, since their occupations hinge on the real estate market. So too for people in the financial sector or geologists who should probably focus investments outside the resource sector.

We saw this play out in real life during the tech crash of 2000 when many people deeply immersed in the technology sector not only lost their careers – their investment portfolios collapsed as well. The same happened during the credit crisis of 2008/2009 when those in the financial sector suffered similar fates.

When we work in a focused sector, we can also risk getting too overconfident in our abilities to understand the investment dynamics of that sector. The fact is that not even an industry expert can anticipate the future movement of the stocks in that sector.

People often focus their wealth into assets that they understand and are comfortable with. It is only when we understand the markets that we will have the confidence to broaden our investment horizons.

Level 4: Enjoy Your Wealth

What is the point of investing if you can’t enjoy it? You’ve worked hard and have earned the right to enjoy it without guilt!

The dictionary defines “enjoy” as “to give joy” or to “take delight in.” Live joyfully!

This is the great transition where our earned income slows down or stops and we rely on other sources that we have built during the working years.

- Government Benefits – You may be wondering when you should apply for your Canada Pension Plan and Old Age Security Benefits. It is important to understand your options and their impact on your future.

- Income Options for your RRSP or LIRA include the Registered Retirement Income Fund (RRIF) for RRSP proceeds, Life Income Fund (LIF) for Locked In Retirement Account (LIRA) proceeds, or a Life Annuity. The RRIF or LIF give more flexibility and control over your income and investment options. The Life Annuity, together with other guaranteed pensions, covers life’s necessities. RRIFs and LIFs can provide for your “discretionary”lifestyle expenses. A financial plan should help you determine the right mix for you.

To best enjoy your wealth, you also need confidence in knowing that there is a plan in case life throws you a curveball, especially when it comes to the potential for increasing healthcare costs.

Level 5: Make an Impact

We also call this level the “North Star” as it guides most of your life decisions.

You’ve probably seen the bumper sticker “I’m Spending My Kids’ Inheritance.” It’s a funny sticker, but this is not a financial strategy.

Think about the Chinese proverb that, loosely translated, says “rags to riches and back again in three generations.” If we build up too much wealth without a plan for its impact, the next generation could easily spend it for us!

By planning to accumulate more than we need, we build in a “Plan B” in case of financial emergencies.

There is a difference between leaving a legacy for the next generation and spoiling them. The best way to prepare subsequent generations is to have conversations about our bright futures and about the finances that help us get there.

As far as how to make an impact, only you can know how you want to be remembered. A great financial plan and advisory team can help you make that happen.

3. Pay Yourself First

The most important cheque is the one you write to yourself.

In 1985, famous comedian and actor Jim Carrey was 23 years old, depressed, and broke. To cheer himself up, he wrote himself a $10 million cheque, dated 10 years in the future. Over the subsequent years, that cheque broke down in his wallet, but it constantly reminded him of his goal to make a great life for him and his family. He easily exceeded his goal.

Although this is a powerful lesson in goal setting, there is a more practical strategy that we can immediately put to work: Always pay yourself first!

It makes so much sense, doesn’t it? Make sure the first cheque you write each month goes to you. It is the most powerful strategy available to us, yet very few people practice it. If you are looking for one simple habit that will help 10X your wealth and financial independence, this is it.

Dollar Cost Averaging

Paying yourself first also gives you access to another very powerful principle called Dollar Cost Averaging (DCA).

Dollar Cost Averaging (DCA) is a simple systematic approach to buying investments. It helps to calm the volatility of your investment strategy by breaking down large investments into smaller ones over time.

The benefits are clear:

- Consistent wealth-building habit. Set up an automatic transfer of funds from your bank account to your investment accounts. Then invest a fixed dollar amount weekly, bi-weekly or monthly into a diversified portfolio, consistent with your risk profile and objectives.

- Consistent investment approach. The ideal investing approach is to buy low and sell high. That is impossible to do consistently. This system is an easy fix. When the markets drop, you’ll buy more shares and when they rise, you’ll buy fewer shares. No more speculation.

- Financial “Easy Button.” Your wealth building strategy is on autopilot and only requires occasional tweaks.

- You come first. Rather than prioritizing everyone else, you get the first cheque!

Few people live on a budget. If they do, they often set the investing bar too low. Budgets are like diets and seldom work consistently. Paying yourself first before anyone else gets a piece of your money is the easiest and most motivating investment system there is.

Work Within a Plan

Paying yourself is a marvelous principle, but you need a proper financial plan and a great advisor for it all to work properly. Important considerations are:

- Time Frame – Will you need access to your money within the next few months, 1-3 years or in longer than 5-10 years?

- Liquidity – how quickly will you be able to access your money. For example, if you invest in a 5-year locked in GIC, you will generally not be able to access that money beforehand.

- Location – There are many different types of accounts to invest your money in and they all do a certain job. RRSPs are used for retirement goals, non-registered savings accounts for shorter term goals and liquidity needs, TFSAs for tax-free long-term growth, etc. Work with your advisor to determine the right locations for your investment plans.

If you are having a hard time with the idea of paying yourself first, imagine that you suddenly had a 10% cut in pay or that an additional 10% tax on your income was just introduced. Then, set up a systematic investment plan for your RRSP, your TFSA, or both and have that amount deducted from your bank account every pay period.

In addition to a systematic way of paying yourself first, you need a plan in place to deal with unexpected inflows of money. This can happen from a raise, bonus, inheritance, retiring allowance from work, sale of a property or even some prize money from an award or the lottery! The default decision should probably not be to blow out the windfall on frivolous expenses, but rather:

- Pay off consumer / credit card debt beginning with the highest interest rate debts.

- Decide on the appropriate accounts where you will invest in.

- Invest the money appropriately for your short to long-term goals.

A Word of Warning

If you have high interest credit card debt or consumer loans, pay them off first. Typical credit cards charge at least 20% interest and there is no investment rate of return that can consistently pay you better than that! Also, interest is usually paid with after-tax income. For example, you would have to get better than a 30 – 40% pre-tax return to beat the effectiveness of paying off credit card debt!

The amount you need to pay yourself depends on your goals, so it is critical that this investing habit be guided by a financial plan that you can work with. To get the ball rolling, we have a wealth of financial calculators on our website that can help you see the impact over time of paying the most important person in your life – you!

4. Protect Your Most Valuable Assets First

Many of us have only fantasized about James Bond’s travels to exotic places, living life on the edge, drinking dry martinis (shaken, not stirred), playing with cool toys and, because I’m a happily married man, I’ll just stop there!

As a financial advisor though, I wonder about James Bond’s financial plan. More specifically, I have to wonder if James Bond is a “Stock” or truly a “Bond.” To answer this question, we need to evaluate his “human capital.”

In a nutshell, human capital represents today’s value of the income we will receive through our working years and through our retirement years if we are receiving a pension. It also represents the value of unpaid work that we do. For example, if James Bond is fresh out of spy school and expecting to earn an income of $150,000 per year, with raises each year of 3% until retirement age of 65 (if he makes it that far), he has a “human capital” value of $3,619,145 at age 25, assuming an investment rate of 6%.

However, if we also assume that James income continues in retirement through a generous MI6 pension until he dies at his statistical age of 74 (after all, most James Bonds were smokers), his human capital value is actually $4,001,887.

This has three key implications:

- Life Insurance – If James was to have gotten married at age 25 (right!) and wanting to leave his sweetheart 100% of his future income if he died, he’d need approximately four million dollars of life insurance to replace his projected future income.

- Disability & Critical Illness Insurance – the same argument for life insurance would apply if James got sick or injured and didn’t die. James would need long term disability coverage to replace his income if he got sick or injured and was not able to perform the important duties as an intelligence officer.

- Investment Portfolio – Despite his very dangerous profession, James has a government paycheque, awesome benefits, a monster pension plan and a totally predictable financial future. If he couldn’t be out gallivanting anymore, he’d surely have a well-paid office position with MI-6. Starting to sound like a bond? So, if James’ human capital of $4,001,887 is like a highly predictable bond, does it not make sense that his investment portfolio contains a higher percentage in long term growth stocks? If instead James was a mercenary, dependent for his paycheque on each new assignment and lacking any pension or benefits of any sort, that would be a lot more volatile. His human capital would resemble a stock and we would need to include a higher percentage of bonds in his investment portfolio to compensate for this “human capital volatility.”

You may not live a 007 lifestyle but you face three key questions:

- What is the value of your human capital?

- Are you a “stock” or a “bond”?

- How will your family be affected if you get seriously sick, injured or die?

Ready for Anything!

Who and what do you want to protect?

Who depends on you?

Very few people are alone on their journey. Will your loved ones or business partners suffer financially in event of your death, injury, or illness? It can be tempting to think that everything will be okay, but what kind of burden would we be placing on our survivors or our family?

Is your health truly your wealth?

We are quick to insure our valuables against fire, theft, and damage. How well have you insured the most valuable asset – your ability to earn an income? Think of the millions of dollars that you could be making in good health. What if your health will no longer support those earnings?

Where do you need clarity?

Do you even need insurance?

What current resources do you have to fill the gap left by serious illness, injury, or death? Where are the shortfalls?

Key decisions:

- Finding the right advisor.

- Correct amount of coverage. Determine this through a thorough needs analysis based on your unique goals and circumstances.

- The right type of coverage. Your plan will help determine this based on your specific goals.

- The right price. Work with an experienced and independent advisor who can survey the entire market for you.

- The right insurer. There are dozens of insurers and you will need help choosing the right one for you.

What do you need to do right now?

Do you qualify?

Insurance companies want to know if they can take a risk on you! By working with a qualified independent advisor, you will be able to determine your eligibility for coverage.

What are you worth?

You are worth far more than you think. It is crucial that you and your family have a risk management plan with an emphasis on protecting your “human capital.” When you have taken all the steps to assure that you and your family are truly ready for anything that life throws you, your confidence will soar.

5. Diversify Properly

There is little predictability in asset class performance from one year to the next. The moment anyone tells you differently, run quickly in the opposite direction!

At the bottom of the market in March of 2009, I had opinions from all sides – clients, other advisors, analysts, and numerous media talking heads. The same rush of opinions happened as the reality of the COVID-19 crisis came onto the scene. In both cases, the markets eventually roared back, proving most of the false prophets wrong again. No one really knew. There is absolutely no shame in that, as long as you know what you don’t know going forward.

Because the sky was apparently falling very quickly back in 2009, many investors wanted to stay in conservative bonds. From March, 2009 through to February 2021, those who invested in bonds grew a $100,000 portfolio to $167,000, not accounting for the poor tax efficiency of bonds. That’s okay, but what would have happened if they had kept equities in their portfolios. To illustrate, I will use indices for the different stock markets.

From March of 2009 through February 2021, $100,000 invested in Canadian Equities (TSX Composite Index) would have grown to $318,000. $100,000 invested in US Equities (S&P 500 Index) would have grown to $664,000. $100,000 invested in International Equities (MSCI EAFE Index) would have grown to $303,000. $100,000 invested in Global Real Estate (Dimensional Global Real Estate Index) would have grown to $553,000. This data was derived from the Returns Web database supplied to authorized industry professionals through Dimensional Fund Advisors Canada Inc. In all cases, investors were rewarded consistent with the risk they took. There was truly no free lunch. Nor could anyone predict which market would outperform another.

I wouldn’t have picked any of those investments alone, but I certainly would have structured a portfolio using all of them in a strategic balance. They all have different random patterns and that can work for your benefit. You see, when you mix them all together, the risk is far less than if you invested in each one on its own. One useful analogy is to think of the many squiggly threads that, woven together, make up a smoother and stronger rope.

Diversification should not be defined by how many stocks or funds an investor owns—or how many brokers one uses. A diversified portfolio should include asset classes that are exposed to different risk factors throughout the world.

Think about your wealth the way major pension managers think about building portfolios that will provide lifetime incomes for their members. Serious wealth embraces diversification.

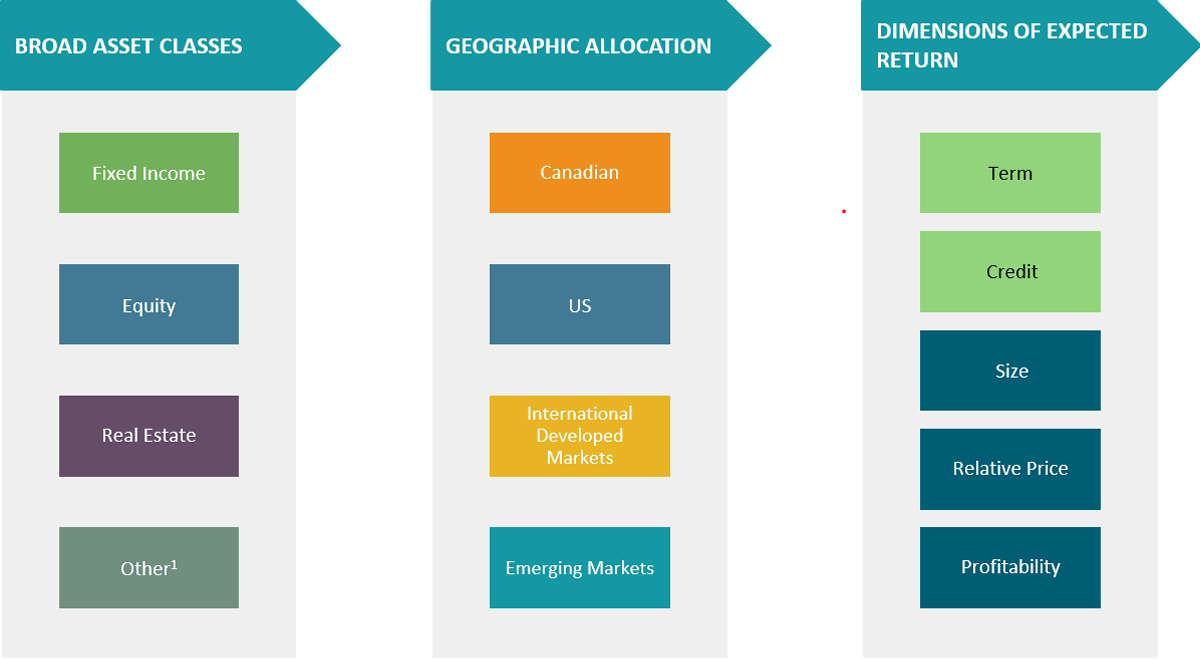

Asset Class Diversification

We first consider the broad classes of investments, including Fixed Income, Equities, Real Estate. Some investment managers include other classes such as commodities, private equity and hedging strategies.

Geographic Diversification

It is a big world outside of North America. Geographic allocation exposes us to broader investment opportunities available overseas, as well as lowering our overall risk.

Accessing “Extra Returns”

We then need to focus our portfolios on those stocks and bonds that tend to give us extra returns. We call these the “dimensions” of expected returns.

Including global bonds in your portfolio may not have a big impact on your returns, but bonds are a great way of toning down the volatility of your portfolio and can also be a source of retirement income to draw from during extended stock market downturns.

The following chart summarize our approach to building great portfolios:

This is no great secret to those who manage serious money, like The Canada Pension Plan (CPP). It invests approximately 23% of its $410 billion dollars into credit instruments and bonds and the remainder into equities spread throughout the world. These mixtures are maintained through thick and thin. Your portfolio should be no different.

The greatest epiphany we have ever had as financial advisors was when we began to know what we didn’t know. All we can do is focus on a financial planning process that works, controlling only what we can control and implementing investing strategies that work in the long run.

6. Avoid Unnecessary Investment Risks

“There’s no such thing as a free lunch.”

Economist Milton Friedman may have said this, but the phrase’s originally dates back to a 19th century practice in American bars of offering a free lunch to entice the more lucrative drinking customers. The free lunch was no real bargain to the patrons, as the more proftable ale quickly soaked up any savings on the lunch!

The same with our investments. Risk and return are very related. For every increase in return, we must take additional risk. You can’t get a higher return for free. The price is in the additional risk.

Risk With No Reward

There are investment risks that are known as “uncompensated risk.” These are risks that, on average, do not give us any extra returns and only serve to add more volatility to your portfolio.

There are the two major risks with no reward:

Concentration Risk

- On March 20, 2000, Inktomi was the top internet search engine in the world and worth $25 billion. Then Google happened.

- In 1975, the Altair 8800 was launched, making cheap, easy to use personal computers. In 1976 Apple was formed.

- In 1997, Walmart was growing its reputation as the world’s top retailer. That same year. Amazon listed on the NASDAQ exchange.

Could you honestly say which of those companies you would have invested in?

Then why pick only a small handful of stocks when you could tap into the global equity markets, a strategy that would have grown your portfolio far more consistently, without trying to be a fortune-teller.

When you look at your wealth like it’s a pension plan, you will expose your portfolio to many more opportunities than by only holding a few stocks. Better still you will lower your overall risk dramatically.

Stock Picking & Hot Tips

We see these risks when investment researchers, well-meaning friends, online discussion forums or misguided “financial advisors” offer us their opinions on stocks or sectors that they feel will outperform in the future. We forget that these “tips” are based on information that is public knowledge and the stocks have been priced accordingly. If the information is truly based on inside knowledge, it is usually illegal to trade on that knowledge and you could go to jail!

Be careful not to fall into the gambling trap in the hope of striking it rich. This kind of behaviour is no different than what we see at the casino or the lottery booth.

Rewarded Risks

Only certain risks within the stock markets offer an expected reward.

Market Risk

The US T-Bill is the global standard for a risk free rate of return. The moment we venture into any other investment, we are increasing not only our expected return. We are also increasing our level of expected risk.

Size Risk

Stock exchanges list a range of small and risky companies to larger, “safer” ones. The market prices its riskier smaller stocks down and increase our effective return in order to “pay” us for the extra risk we are taking.

Price Risk

“Price risk” exists when the market has sold down the price of a stock due to perceived risk (value stocks) or when it has bid the value up to reflect its perceived potential earnings growth (growth stocks). Imagine the stock market as a department store. Are potential buyers eagerly lined up outside, or do we need a 50% sale to attract our interest? Although I usually buy when goods are on sale, I may risk getting merchandise that is out of favour for various reasons. If there’s quality there, I may be willing to pay full price though. Getting the picture?

Stock prices rise and fall, reflecting investors’ opinions of the underlying companies’ future prospects. The trick is that no one can reliably tell the future of these companies.

Growth of $1 US Dollar from 1927 - 2021

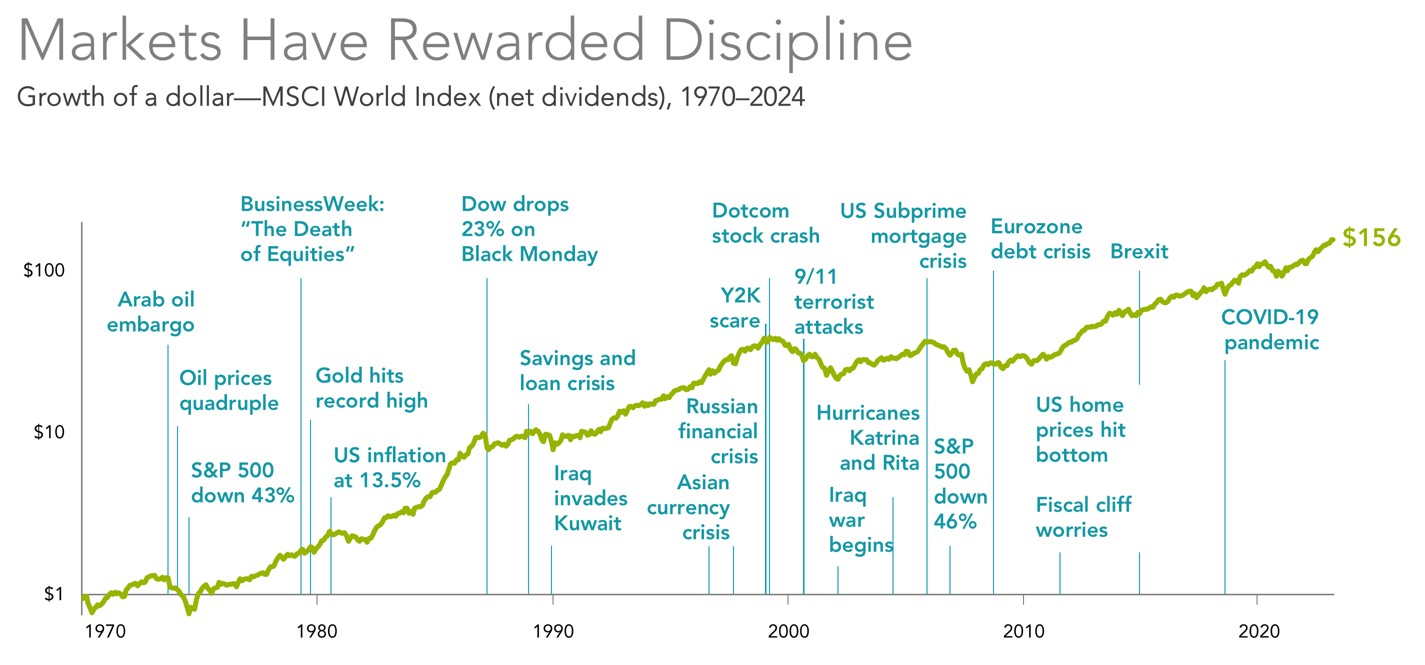

7. Stay in Your Seat

No game-plan.

Behind the bench, the entire sporting organization doesn’t just have a strategy for pursuing the next goal – they have a plan for winning the season. Your financial plan should be structured to help you win at all seasons of life.Taking our eye off the ball.

Instead of establishing regular investing habits, we get distracted from the meaningful goals and defaulting our dollar toward the shiny and often wasteful objects and experiences that capture our attention. Alternately we can also let our dollars accumulate in the wrong investments and miss out on some great opportunities.Losing heart.

Have you ever been to a game that’s going badly and watched all the fair-weather fans leave early only to miss out on a power-play goal in the last minute to tie up the game leading them to an overtime win? Same thing with investors who lose heart when the market inevitably drops and sell their portfolios to cash, waiting for the crisis to pass before they get back in again. We all know how badly that scenario usually ends up. Just as in missing the winning goal in a sporting event, the impact of missing just a few of the market’s best days can be profound. For example, I will draw on an investing experience from 1970 through to March 17, 2020, using the S&P 500 Index of the top 500 US stocks:- $1,000 invested in 1970 and left alone would have turned into $121,353.

- If we missed out on only the five best days during that period, we would only have $77,056.

- If we missed the 25 best days, our capital would have dwindled to $26,989.

There is absolutely no proven way to know when to get out or into the market. Anyone who claims they have the magical answer is lying. History and evidence tell us to stay put through good times and bad. The next time you see a game, you decide whether you get up for a hot dog or a drink. Your life won’t change too dramatically. When you invest your hard-earned wealth though, my best advice is to stay in your seat.

Markets Have Rewarded Discipline Over Time

Growth of a Canadian dollar – MSCI World Index (net dividends) from 1970 – 2020

8. Avoid Unnecessary Fees and Taxes

In our exuberance to invest, we often pay little attention to the impact of excessive investment costs on our portfolios. Successful investing involves controlling these costs.

Here are only a few instances where investment costs can get out of control:

- Investors behaving badly

Sheep that we are, investors have been following the herd lately and buying stocks now that we’re feeling a bit better about the economy. In 2008/2009, we were fleeing stocks as prices dropped throughout the great credit crisis. This is as illogical as stocking up on toilet paper at regular price to last us through those horrible 50% off sales!

- Active Investing

Active managers try to beat the market through stock selection and market timing. They try to convince us that luck is a skill! History tells us that this is a zero sum game! The more a portfolio is traded, also known as turnover, the higher the trading costs and taxation.

- Trading Costs

Every time a trade happens, there is a difference between what the seller wants (the “ask”) and what the buyer is willing to pay (the “bid”). This is a very real trading cost whenever a trade takes place. The active manager who frequently trades in a portfolio thus pays higher costs than the buy and hold passive manager. Using portfolio analytics software, we are able to determine this degree of “turnover” and avoid managers who are sustaining these costs. These costs are not disclosed in a fund’s management expense ratio, yet have the potential to seriously erode investment returns.

- Management Expense Ratio (MER)

- The fee that the investment manager charges.

- The financial advisor’s compensation

- The fund expenses, including GST/HST

Higher fee do not necessarily mean that you are getting better investment management expertise. What you want is the best combination of sound investment strategy, control of expenses and a reasonable fee for quality financial advice. You need to know the total fees charged and, more importantly, the value that will be received in return.

- Reconstitution & Tracking Error

Investing in an index fund or index Exchange Traded Fund (ETF) sounds like a no-brainer. The problem is that you will not necessarily get returns that match the underlying index. You see, an index fund basically chases the index after the fact, as it is impossible to tell which stocks will form the index in the future. This has index fund managers scrambling to buy or sell stocks at the same time as all the other index fund managers every time the index decides which stocks are added and which stocks are left behind. The end result is what is known as “tracking error” due to the extra costs the index fund pays when they overpay for a security when adding it and when they sell for a discount when removing a holding.

- Cash Drag

Investment Fund Managers often keep large balances sitting idly in cash. They try to tell us that this money is an “opportunity fund” held aside for the purpose of taking advantage of “bargains” as they arise. Truthfully though, these funds are kept aside to fulfill requests for cash when investors want their money, often at the worst time such as when the markets drop! By looking for institutional managers who only work with long-term oriented investors and advisors, you will have a greater chance that all your money is invested in the target asset class that will give you the rate of return you require. There is nothing wrong with holding a cash balance for your own personal short term goals. However, there is no place for a serious investment manager to be sitting on a large cash balance.

- Shareholders

Although most mutual fund companies try to maximize returns to their unit holders, their real job is to generate positive returns to shareholders in their company. Lowering management fees and, therefor, revenue will likely go over like a lead balloon!

- Small Accounts

Investors with larger account sizes routinely subsidize smaller accounts. Consider the promotional, administrative, overhead, printing and mailing costs to set up an investor beginning with as little as a $25 per month! These “subsidies” are no small part of most investment funds’ expenses.

If you are serious investor, you can’t be holding the same portfolios as the startup investor holding smaller accounts.

- Taxation

We often mis-use our RRSPs and TFSAs. They are incredible tax-planning tools but we often use them at the wrong time and for the wrong purposes. We have to constantly monitor your tax situation to assure we are making the best use of such tax planning tools according to the stages of our financial plans.

Outside of an RRSP or TFSA, a frequently-traded portfolio often translates into heftier T3 slips and that means more tax paid each year, rather than enjoying the benefits of tax-deferred compounding. Additionally, when we don’t understand the differing tax treatments between interest, rent, dividends and capital gains, we could be losing thousands of dollars.

Over your lifetime, a well-diversified and cost-effective portfolio could result in a doubling of wealth over and above a portfolio burdened with unnecessary costs. That sure can make a difference in your future lifestyle!

9. Plan for Inflation

As a child, I vividly remember my grandmother giving us each 50 cents to spend at the corner grocery store. Those 50 cents would buy as much as a bottle of cream soda, a bag of chips, chocolate bar and a comic book.The good old days!

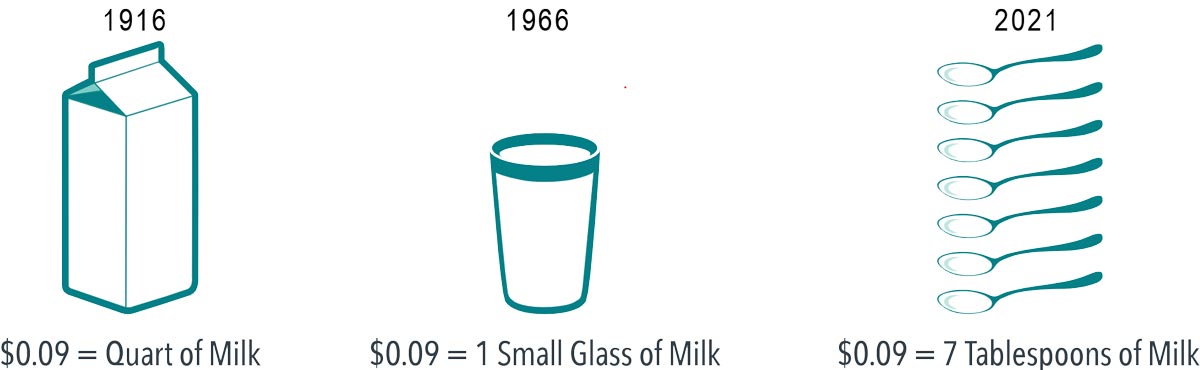

As prices of goods and services increase over time, your dollar will buy less of them. This purchasing power erosion is called inflation and it will always be with us.

Inflation is an important consideration when investing. After all, the reason for saving today is to support future spending. Therefore, keeping pace with inflation is a crucial goal for many investors. To help understand inflation’s impact on purchasing power, consider the following illustration of the effects of inflation over time. In 1916, nine cents would buy a quart of milk. Fifty years later, nine cents would only buy a small glass of milk. And more than 100 years later, nine cents would only buy about seven tablespoons of milk. How can investors potentially prevent this loss of purchasing power from inflation over time?

Your money will likely buy less tomorrow.

As the value of a dollar declines over time, investing can help grow wealth and preserve purchasing power. In the long run stocks have outpaced inflation, but there have been short-term stretches where this has not been the case. For example, from 1966–1982, the return of the S&P 500 Index was 6.8% before inflation, but after adjusting for inflation it was 0%. Additionally, from 2000–2009, the so-called “lost decade,” the return of the S&P 500 Index dropped from –0.9% before inflation to –3.4% after inflation.

Despite some periods where stocks have failed to outpace inflation, one dollar invested in the S&P 500 Index in 1926, after accounting for inflation, would have grown to more than $750 of purchasing power at the end of 2020, significantly outpaced inflation over the long run. The story for US Treasury bills (T-bills) is quite different though. In many periods, T-bills were unable to keep pace with inflation. After adjusting for inflation, $1 invested in T-bills in 1926 would have grown to only $1.49 at the end of 2020. We call that “Going Broke Safely!

Purchasing Power of Stocks Adjusted for Inflation

While stocks are more volatile than T-bills, they have also been more likely to outpace inflation over long periods. The lesson here is that volatility is not the only type of risk to worry about. Ultimately, many investors may need to have some of their allocation in growth investments that outpace inflation to maintain their standard of living and grow their wealth.

You Can Plan for This!

Inflation is an important consideration for many long-term investors. By combining the right mix of growth and risk management assets, investors may be able to blunt the effects of inflation and grow their wealth over time. Remember, however, that inflation is only one consideration among many that investors must contend with when building a portfolio for the future. The right mix of assets for any investor will depend upon that investor’s unique goals and needs. A financial advisor can help investors weigh the impact of inflation and other important considerations when preparing and investing for the future.

10. Get Professional Advice

Investors are happy when the markets are up and they are sad when the markets are down. The data tells us clearly that investors, on average, buy into the markets when they are up and sell out of the markets when the markets are down.

This is where a professional advisor can help us be mindful of our emotional responses.

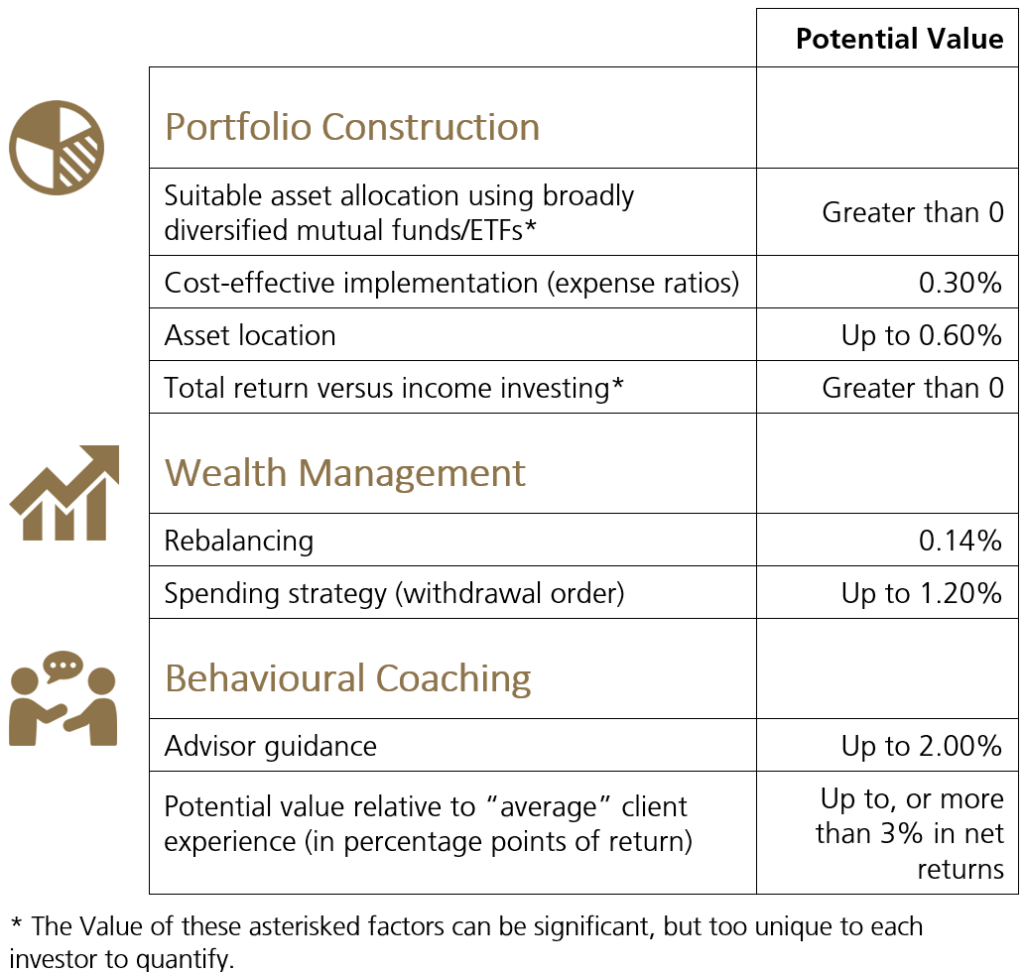

Vanguard Advisor Alpha Study

In a 2018 study, The Vanguard Group Inc. found that the potential value added by a professional investment advisor amounts to about 3% additional rate of return over that experienced by investors who are not using the following strategies:

When you work with a qualified independent advisor who truly has your best interests at heart, it can make a huge difference. You get to keep more of your returns while getting better financial planning and potentially better tax efficiency. You will also have greater peace of mind knowing your portfolio risks have been reduced.

Gamechanger - Your Financial Advisory Team

Years ago, I had a goal that, before our sons graduated from University, we would travel through Europe together. I first had that opportunity with Peter and Matt in 2011. We first arrived in Pompeii to meet Peter who was there with his Classical Studies class and Pompeii was his specialty!

Matt and I couldn’t tell a relic from a rock! Fortunately, we had Peter! He took us on a tour that had us truly imagining what life was like before Mount Vesuvius exploded. He intimately knew about life in ancient Pompeii. More importantly though, he knew us and knew how to connect us with the experience.

Navigating your finances is no different. You need a qualified financial advisory group. More importantly, you need to build a long term relationship with an advisor who knows you, your obstacles, your opportunities and the goals that matter to you.

The first of the “10 Steps to 10X Your Wealth” is to Start a Financial Plan. This is advice worth repeating because it is where you will need the support of a Financial Advisor more than ever.

If you are interested in professional advice, our process may interest you:

- Focus

- Which goals matter to you? To paraphrase The Cheshire Cat in Lewis Carroll’s Alice in Wonderland, “if you don’t know where you are going, any road can take you there.” It is important to know the destination before we embark on the journey.

- What keeps you awake at night? It is entirely understandable that the obstacles you face may spark uncertainty and even fear. This can affect your confidence. Our planning process will help you overcome those obstacles.

- What opportunities excite you? Is it travel, spending more time with family or perhaps having an impact in your community? Are you saving up for a first home or a recreational property to build family experiences around?

- Clarity

- Clarity on where you are now. We will help you to understand your current financial situation and advise you on the information you will need.

- Interactive Financial Planning. Because life changes so quickly, a nimble, interactive approach is necessary.

Important questions your financial plan should answer:

- Will I have enough money?

- How long will my money last?

- When can I retire?

- When should I take my CPP & OAS?

- How much to spend & not go broke.

- When should I draw on my assets?

- Is my current level of savings enough?

- How much will I pass to my family?

- Will my family be okay if I get sick, hurt, or die?

- Progress

- The Progress Planner. Taking obstacles and challenges and transforming them into step by step solutions that help you move toward your goals.

- No stone unturned. Every step forward will trigger further progress. Together, we will discover new opportunities and continually move forward.

- The plan never ends. Life changes! Your financial plan must continually adapt to those changes. Pursuing the goals that matter to you will be a lifelong process. Our review process assures that you will have a trusted advisor along the way.

But Really... Does it Work?

All this sounds so good in theory, doesn’t it?

Every one of these ten steps can definitely help you improve financial independence, grow your wealth, reduce your risk and reduce costs and taxes. When combined together though, can the compound effect truly 10X your wealth?

The only way to find is by asking the question within an understandable financial planning progress that actually works.

The Value of Advice

When we pay fees to an advisor to help us financially reach our goals, we want to know for sure that we are getting value in return.

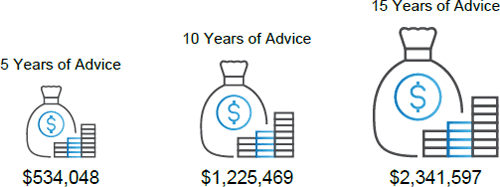

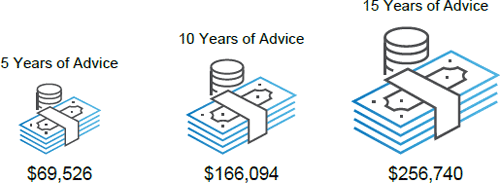

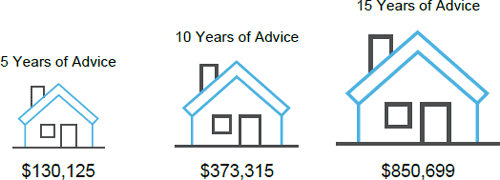

Fortunately, our technology measures the impact of the financial planning recommendations we make. The following charts are examples from one of our sample cases that show you the value of advice given in five areas of financial planning:

- Financial Management

- Investment Management

- Tax Planning

- Retirement Planning

- Risk Management

- Estate Planning

These examples are from a sample scenario where we apply all ten steps to achieve a truly exponential results. Your results will be different depending on your situation, time frame and resources.

Sample Outcomes

Projected Increase in Net Worth

Projected Increase in Investment Assets

Projected Reduction in Income Tax Paid

Cumulative Increase in Attainable Lifestyle

Projected Increase in Estate Value

Achieve the Goals that Matter to You

A Plan Just

for You

Because we all have unique goals, priorities, and circumstances.

Clarity and

Direction

Because we all have unique goals, priorities, and circumstances.

Support Along

the Way

Because we all have unique goals, priorities, and circumstances.

Reaching your goals and dreams is the most rewarding but hardest work you will do. It is even more difficult when you do not have the support you need to get there. We truly look forward to have a conversation to see if we can be a part of your journey. Click below to schedule a complimentary conversation.

Richard Vetter

BA, CFP, CLU, CIM, CEA

Certified Financial Planner

Portfolio Manager

Matthew Vetter

BA, CIM

Portfolio Manager

Zinha Vetter

Client Care Coordinator