Comprehensive advice coordinated with your other professionals, in all 6 areas of your financial picture.

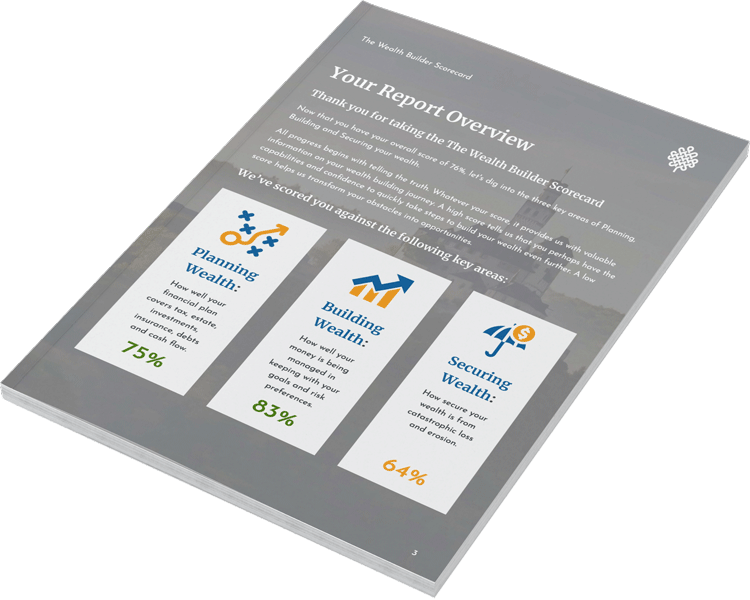

Clarity – Discover what you want most and where you stand today.

Clearly understand what’s important about building wealth to you. Focus on your top financial goals.

Progress – Understand what you need to do right now to move forward.

Identify the action steps required to achieve the goals that matter to you!

Confidence – Adapt, grow, and live confidently through all of life’s transitions.

In teamwork with you and your other professionals, we will focus on your highest impact strategies.